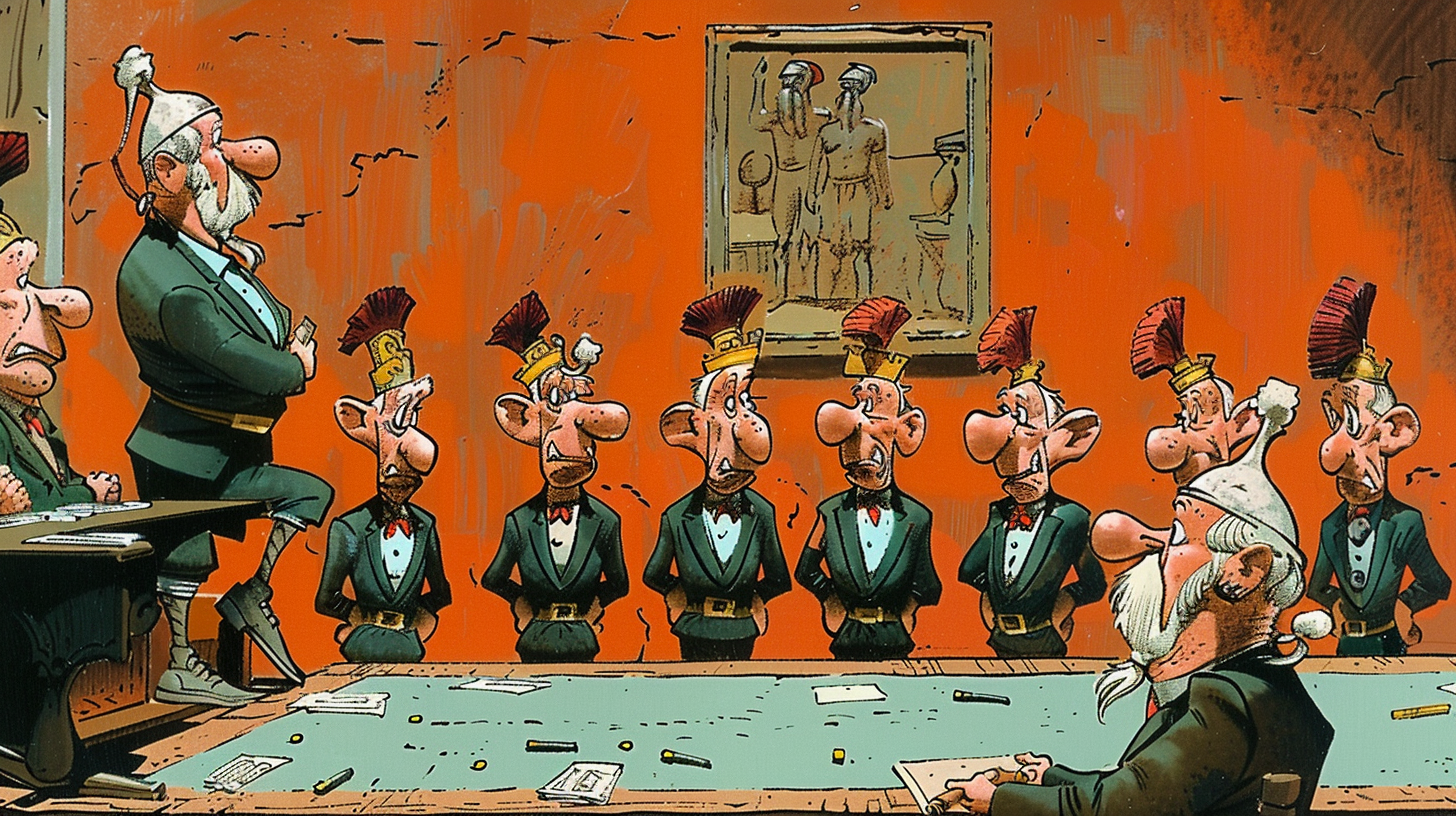

Remember the cartoon about Asterix and Obelix — those two Gauls from a tiny village who were the last to stand up to the mighty Roman Empire that had conquered everything around them?

Well, something similar seems to have happened in the venture world — only in reverse.

Let me explain. But first, a general observation that’s crystallized for me over years of work and watching the venture capital game unfold.

I don’t claim to hold the ultimate truth, but I’ve had some exposure:

- GP of two early-stage VC funds with 25+ seed-stage deals closed;

- CEO of one of Eastern Europe’s largest startup studios;

- Experience in several M&A deals;

- Co-founder of a couple of companies, one of which grew large enough for me to take over innovation and venture strategy — including launching a corporate VC fund;

- Which, among other things, landed me on the Top 50 Corporate Innovators list (shoutout to GSV — thanks for noticing!).

If you're curious about my background, here’s a piece where I go deep into that recent chapter.

Now, here’s what I think about the current state of the venture capital market.

The Core Idea

Maybe it’s time to admit that the venture capital business model really works — systematically, predictably, repeatably — only for a small Gallic village. In our world, that village is the Bay Area (San Francisco). And even there, to be fair, it only truly works for the top 20 funds in that village.

Everyone else (yes, there are exceptions — but too few to matter statistically) is basically relying on randomness and lucky vintages — the years when most of the investments were made.

By “vintage,” I mean that sweet spot when you happened to invest. Nobody really picks the “right” years on purpose. But in hindsight, it’s clear: funds that did seed deals in Year X tend to outperform those that invested in Year Y, often by orders of magnitude — even though the GPs, experience, and processes are roughly comparable.

The same logic applies to startup studios and accelerators.

If you launched your startup or seeded companies in 2011–2014, and exited between 2020–2021, and your geography was the US — chances are, it worked out well.

If you were doing seed deals between 2018–2020, outside the US... how’s your portfolio doing in 2025? Any exits? Any markup?

These days I live in Germany. I like the country and its people, and I really hope the transition to a next-generation digital economy goes smoothly here — especially for friends of mine at Campus Founders.

But this same challenge is playing out across nearly every region in the world — except that one stubborn little Gallic village. So let me try to help with a few thoughts on how to improve the process.

Why the Venture Model Doesn’t Work (Almost Everywhere)

From here on, when I talk about a “non-working model,” I mean anywhere outside the US (where it still works — though not universally) and China (where I don't have enough firsthand insight).

To fix something, you need to understand why it's broken.

Because at first glance, it all looks fine:

- Tons of companies are being created;

- Funding flows freely;

- Startups grow into tech giants with crazy valuations.

Everyone’s trying to build their local Silicon Valley — their own Gallic village.

But results are... disappointing.

Strange, right? I mean:

- Experts? Plenty.

- Seed funding? Accessible.

- Coworking spaces, labs, innovation hubs? Check.

- Smoothie bars, scooters, MacBooks, even a startup-y sense of freedom in authoritarian states? All there.

So what’s missing?

The answer: cargo cults. We copied the form, not the function. We cloned the aesthetics, but not the business model.

The real model is built around high-risk assets with even higher potential rewards. It only works with a portfolio approach: you fund a bunch of companies, most die, but one hits so big it makes up for the rest.

The cornerstone of this system? Exits. Big ones. These exits must pay for the entire party — spanning 7 to 10 years.

So... which regions actually produce consistent high-value exits?

Because if exits aren’t happening, the entire model breaks down. It doesn’t matter how many floors your startup hub has or how trendy your accelerator is.

Investors who cashed out from Deal A can’t reinvest in Deal B. Employees who worked 10 years and sold stock options can’t become angel investors or launch the next startup.

What Kind of Exits Are We Talking About?

There are only three real options:

- IPO (great, but rare);

- The company becomes self-sustaining and pays dividends (even rarer — and doesn’t fit the VC 7-year model);

- Acquisition by a strategic (the most realistic and dominant path).

To be clear, 90–95% of exits come from acquisitions by strategic buyers. If that channel isn’t working, the rest is a rounding error.

So What Else Is the Problem — Besides Market Size?

Now we get to the fun part.

Most regional innovation hubs, startup support orgs, and corporate innovation departments are actually pretty competent.

They know how to vet ideas, build MVPs, fund early rounds, and help founders. People with industry experience work closely with startups, mentor them, and help them grow.

And then comes moment X.

The startup is scaling hard. It’s time to raise hundreds of millions or sell for hundreds of millions or even billions.

That's when the trouble begins. Two scenarios:

Problem 1: Strategics Who Think “We’ll Just Build It Ourselves”

If the acquiring company is technically strong, the biggest threat to an exit is not competition — it’s the internal teams who believe they can do it themselves, probably even better.

And you know what? They’ve got:

- Customer access;

- Unlimited budgets;

- Armies of devs and experts;

- Best practices, frameworks, playbooks...

Sure, it’ll take some time — but it’s doable, right?

So why pay $300M+ for a buggy, legacy-ridden startup when you can build a clean version in-house?

Problem is... this almost never works.

If it did:

- Google would’ve launched five successful social networks;

- Microsoft would dominate search;

- Meta would own the B2B SaaS space.

But they don’t.

Despite having unlimited resources, these giants routinely fail to create viable businesses in unfamiliar categories.

It’s kind of like childbirth: It takes 9 months to make a baby. You can’t get nine women together and finish it in a month.

Try to justify yourself within the corporation when you have spent a ton of resources and two years, but have not created a "new Instagram". Most likely, you will be dismissed, another person will be hired, and a new two-year cycle will begin. Or, during this time, the strategy will change, and your project will no longer be relevant.

Although in reality it would have taken 3-4 years and significantly fewer resources. But corporations are unlikely to tolerate this.

Problem 2: Strategics Who Can’t Pull the Trigger

If the acquirer doesn’t have infinite resources, now you’ve got a classic investment decision.

And that means: board approvals. Or one single CEO making a bold call.

You bring them a startup:

“It’s growing fast. Huge potential. Clear synergy. Yes, parts are still broken and falling off monthly, but it’s working!”

All it takes is another $300M+.

Questions start flying:

- NPV?

- Risk of death in 12 months?

- Competitive landscape?

- How much have they burned already?

- How profitable are they?

Then someone suggests another option:

“What if we just built a factory or another real estate block? Same money, bank-financed, predictable NPV, steady cash flow…”

Even if it underperforms, we won’t lose everything. Unlike a failed startup, which gets written off to zero.

This is the innovator’s dilemma.

And Here’s the Catch

The entire venture model depends on someone inside a corporation being willing to sign a huge check.

But most of these decision-makers:

- Are not startup-native;

- Are rational and risk-averse;

- And have plenty of safer alternatives for capital allocation.

It’s not stupidity — it’s pragmatism.

But the result is:

- You can start a startup;

- You can grow it through seed and Series A;

- But when it’s time for real scale — you hit a glass ceiling.

No exits = no venture model. No matter how many startups you fund or how many Demo Days you run.

I Used to Think This Was Just an Eastern Europe Bug

But in the last few years, I’ve realized it’s a global feature. No region has solved this — except the Bay Area.

So What Do We Do?

If, for whatever reason, you’re still committed to building a classic venture model — start by answering two questions:

- Where will your big exits come from?

- How will you bypass the strategic decision-making bottleneck (which is responsible for 95% of all exits)?

You might need:

- a dedicated investment vehicle inside a corporation;

- or a separate approval path, distinct from typical large-transaction governance processes.

But personally, I believe more in embracing your constraints and building models around them.

Who said the venture model is the only option?

Other directions include:

- Cash cow models, focused on profitability and R&D, not exponential growth;

- Corporate collaborations where no massive one-off transaction is needed;

- Public-sector involvement — where it works (and yes, in some countries you’ll regret taking even a single dollar from the government, but there are solid exceptions). Tools like tax incentives, state-run co-investment funds, or even management buyout support via unions or pension funds can increase exit frequency;

- Dual-economy structures (which I’ve written about briefly elsewhere);

- Joint Ventures — where multiple corporations co-own a startup. Yes, control issues will arise. But they’re solvable.

There are dozens of potential architectures.

What matters most is this: If you haven’t solved the exit problem, diving into a venture model is an act of madness and courage.

Which is fine — beautiful even. Just let it be intentional.

That way, we’ll spare millions of souls from false expectations (hello cognitive dissonance), and from the quietly tragic outcomes that tend to follow.